Talk about rentiership and intellectual monopoly is all the rage in academia. But there have been surprisingly few efforts to measure them at the firm level. In a new CITYPERC working paper, Joseph Baines and I explore why this is the case.

The reason for the lack of empirical evidence, we claim, is conceptual. To distinguish profit from rent we need to distinguish productive versus unproductive activities, scarce versus non-scarce assets, and competition versus monopoly. As we explain in considerable detail in the paper, this is an impossible task. Where exactly is the dividing line between scarce and non-scare assets? How do we determine when prices are competitive? Where does free competition end and limited competition begin?

We argue that these untenable dualisms arise from rent theory’s partial mooring in a substantialist ontology that holds that value is generated or expressed in one domain of activity (production or perfect competition) and captured or distorted by others (predation or market power). In rejecting the substantialism that underpins existing approaches, we advocate an ontology of process. In this view, there are no “pure” rents just as there are no “pure” profits. At best we can say that there is a process of rentierization emergent in all capitalist relations.

Rentierization and (intellectual) monopolization are open-ended tendencies towards exclusionary control over production, distribution and consumption that are continually evaded, contested and reversed, thereby never reaching a consummated end-state.

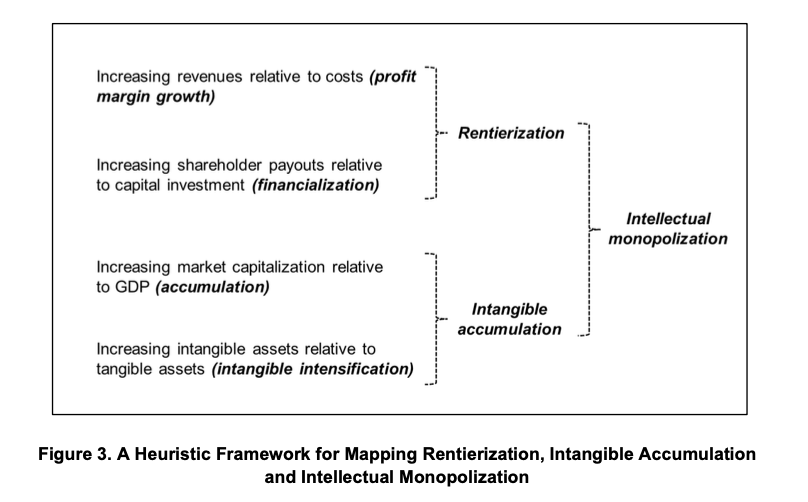

This leads us to a new heuristic framework (as outlined in Figure 3 of the paper):

- Rentierization occurs when firms successfully raise profit margins in service of shareholder returns rather than in service of financing future growth. In other words, rentierization occurs when firms raise revenues relative to costs, and increase dividends and shareholder buybacks relative to capital investment.

- Intangible accumulation occurs when firms successfully increase the intangible assets in service of increased market capitalization. In other words, intangible accumulation occurs when firms expand their intangible assets relative to their tangible assets, and when their market capitalization grows faster than underlying economy activity.

- Intellectual monopolization occurs when firms successfully combine rentierization with intangible accumulation. In other words, it occurs when firms raise revenues relative to costs, shareholder payouts relative to capital investment, intangible asset values relative to fixed tangible assets, and market capitalization relative to economic growth.

Based on this framework, we explore these processes for the US non-financial corporate sector from 1950 to 2019. We show that rentierization and intangible accumulation are widespread and have been increasing in recent decades. Though widespread, a disaggregate analysis shows that the timing and intensity of rentierization and intellectual monopolization varies by sector and by size.

Over the past few decades the largest corporations have experienced growing profit margins, shareholder payouts, market capitalization and intangibles intensity. These processes have been especially prominent amongst large corporations in the pharmaceuticals sector but also in apparel and footwear, defence and aerospace, food and beverage, heavy industry, and hotels and restaurants. Further down the corporate hierarchy, processes of rentierization and intellectual monopolization are much less widespread but can be found in the footwear and apparel and defence and aerospace sectors.

Overall, our measures illuminate the variegated landscape of corporate power in the US, and they offer useful pointers for critically interrogating processes of rentierization and intellectual monopolization in other contexts.

Our working paper recently featured in an article by Luke Goldstein in The American Prospect.