Fruitful collaboration with the good folks at Common Wealth continues. A few weeks back Joseph Baines and I compiled data on dividend payments, profits and tax rates for their report that outlined bailout conditions for the aviation sector. Now we have helped out with a new report that explores the implications of the suspension of the rail franchise in light of the coronavirus pandemic.

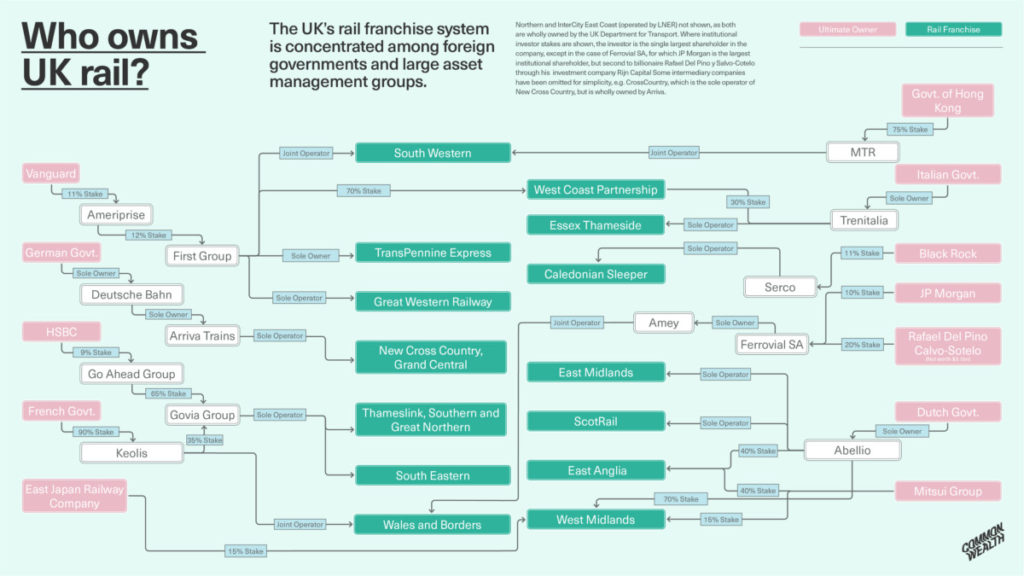

As the report explains, the rail franchise suspension (a provisional nationalisation) means that revenues and cost risks have been shifted to the government. So who benefits from this temporary nationalisation of the losses? To address this question, we decided to look into who actually owns the UK railway system. In doing so, we discovered an ownership structure of dizzying complexity. But as this stunning graphic shows, ownership of UK rail is dominated by a handful of powerful shareholders, operating companies, and foreign governments.

Instead of a no-strings-attached bailout for shareholders and private investors, the report argues that “…public support for railways must be associated with strong conditions that support long-lasting social, economic and environmental benefits for the public.” These conditions include: guaranteed protection for railway workers, free rail travel for key workers during the crisis, and, in the longer-term, reclaiming public ownership over the highly-dysfunctional privatised railway system.