Joseph Baines and I have been working together with Common Wealth on research into the behaviour of UK corporations in light of the coronavirus bailout measures. Earlier this week Common Wealth published a briefing focusing on the UK aviation sector. In it, they argue that any “…bailout of the sector must be contingent on ensuring job security, action on climate change, and a strategic public ownership stake.”

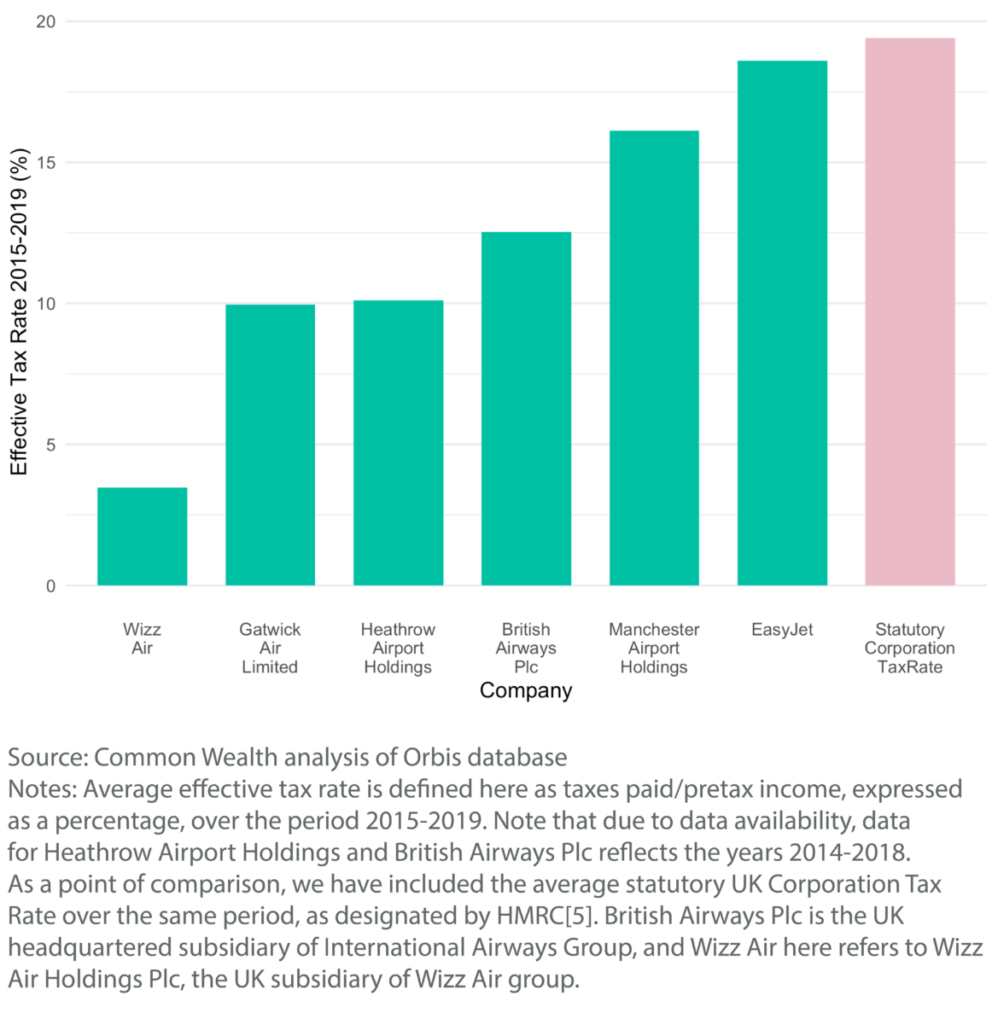

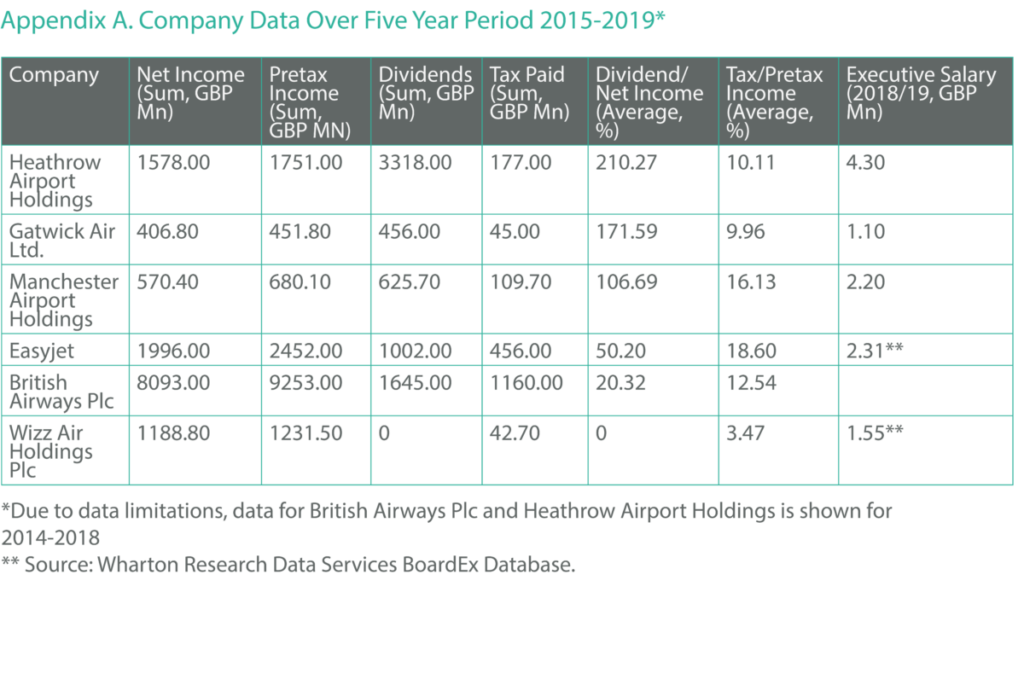

Compiling data for the major airlines and airport companies, we came up with some pretty alarming results. What we found is that effective tax rate of all the major aviation companies is lower than the statutory UK corporate income tax rate of 19.4 percent.

Digging further into the financial statements of these companies, we found that they pay out a staggering amount in dividends. For example, from 2014-2018, Heathrow Airport Holdings paid out dividends representing 210 percent of its net income, yet faced an ETR of just over 10 percent.

The report outlines five conditions that should be attached to any bailout of the aviation sector:

- No lay-offs, with firms taking full advantage of the Coronavirus Job Retention Scheme

- Embedded worker rights and collective bargaining over wages and conditions

- The sector to pay its fair share in taxes

- Adoption of climate targets by the sector in line with 1.5 degrees and clear, transparent plans to meet them

- A permanent public stake to grow public wealth post-crisis